Thanks to Kidibank for sponsoring this post!

BELOW: We all want to teach our kids about money so they can be financially responsible adults, but there’s a problem with our current teaching methods. I dive into what that problem is and how to rectify it.

I check the clock. We have 15 minutes to leave the house before we’re officially running late for my daughter’s field trip.

I turned in the permission slip the other day, but still need to bring the $11.50 I owe the teacher, so I’m digging through all our change buckets, hoping to find some green.

I find a dollar bill and a couple of quarters in one bucket and nothing but old receipts and gift cards in another.

A purse perusal unearths another $5, which is a surprise since I rarely carry cash. Unfortunately, I’m still $5 short and the clock is ticking closer to departure time.

Finally, in an act of desperation, I head to my sons’ bedroom and grab one of their piggy banks. After pulling out the rubber stopper, I dig around and pull out a wad of bills. I count out five, shove the rest back in, reinsert the stopper, and place the bank back in it’s spot, hoping he won’t notice it’s been tampered with.

“I’ll reimburse him,” I promise myself as I head down the stairs, calling for Annelise to put on her coat.

There’s just one problem with that promise: By the time I have the cash on hand, I’ll have forgotten all about it.

How We Currently Teach Our Kids About Money

My husband and I have always been careful with money. We don’t spend more than we make. We pay off our credit cards each month. We (try to) budget.

When it comes to money management and saving for the future, I’m thankful I married the man I did. Not only do we share similar views when it comes to saving and spending, but he’s also more financially savvy than me, which makes up for my lack of retirement savings knowledge.

Since we both agree about the importance of good financial management, we’ve already begun to impart this value onto our kids.

We talk a lot.

We talk about how things cost money. How Daddy and Mommy work hard to earn the money that pays for our needs and wants. How we need to take care of the things we own so as not to be wasteful.

We talk about how credit cards work. How that magical piece of plastic is not something that can just be swiped whenever something catches our eye. How at the end of every month all those things we swiped for must be paid with real money.

We talk about giving. How richly we’ve been blessed and how it’s our responsibility and privilege to bless others. How the first portion of every paycheck should be given towards the things we believe in.

But talking isn’t enough, especially for abstract concepts like spending and saving. Kids need to learn by doing and by having concrete examples.

So we’ve tried Give, Save, Spend jars. We’ve tried allowances and earning money for chores that go above and beyond. We’ve tried a bunch of things, but none of them have stuck.

At first I blamed it on our inconsistency, and I would say that’s definitely a part of the problem.

But on the morning that I scrambled around looking for cash, I realized the other part of the problem.

We’re trying to teach our kids with tangible cash money when we rarely use it ourselves.

Think about it. We are quickly becoming a cashless society.

Unless you use the cash envelope system to budget, you probably use credit cards or debit cards for a lot of your purchases. I know we do.

Even checks are becoming obsolete. A study in 2015 showed that over 78% of people pay their bills online rather than by check.

What does this have to do with teaching our kids about money? EVERYTHING.

The prevailing wisdom for how to teach kids financial management is to give them cash to handle. I don’t think this is entirely off-base. Kids need to learn how to use cash.

But they also need to learn about money management through the lens of an increasingly electronic society.

They need to learn about bank accounts and credit cards and a positive balance vs. being ‘in the red.’ They need to learn that the amount of money they have can change with the touch of a screen and that purchases must be reconciled with the balances in their accounts.

So for the moment, I’ve stopped feeling guilty about our lack of consistency with the Give, Save, Spend jars. We won’t do away with them entirely, but I’ve come to realize that they can’t be our only teaching method.

How We Need to Start Teaching Our Kids About Money

We also need to teach them about money in the way they’ll encounter it as adults.

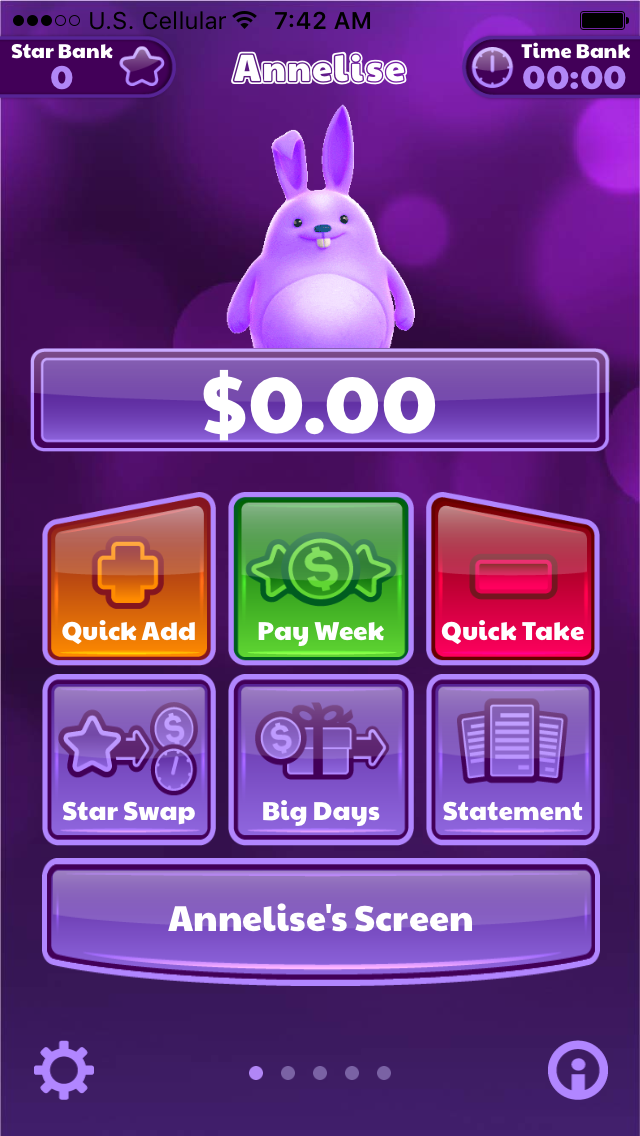

I was recently introduced to Kidibank, an app that helps you teach your kids financial management by allowing you and your kids to keep track of their saving and spending. It’s brand new (just came out last week), so I’m still learning all the ins and outs, but so far I’m finding that it has a ton of great features.

Here are a few of my favorites:

- You can add four adults and six kids on one account, making it easy for all the adults in the family to keep track of the kids’ balances and add or subtract as necessary.

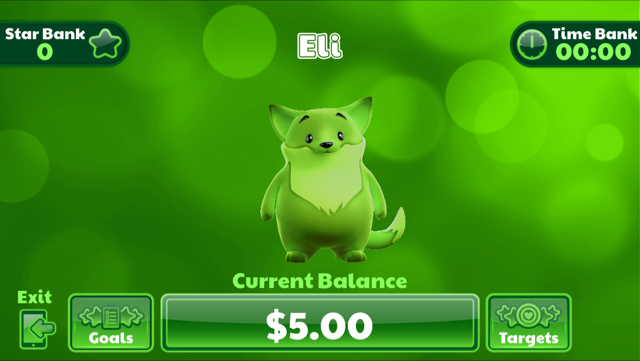

- The kids can access their own screen to see their balance, goals, and targets, but don’t have access to the controls to, oh I don’t know, add a million dollars to their account.

- It’s not just for money! It also has sections to keep track of screen time and rewards.

- It’s fully customizable.

- Do you give your kids an allowance? Automate the app to add the money to their accounts each week.

- Don’t give your kids an allowance? Add money on a one-time basis.

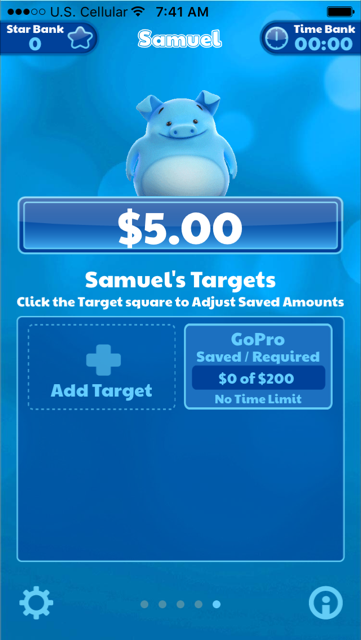

- Do your kids want to set a savings goal (Kidibank calls them Targets)? Easy peasy.

- Want to transfer some of the reward stars they’ve earned into extra screen time? Done.

- It’s always accessible. We don’t carry the kids’ cash around with us, but I do always have my phone. If we’re at the store and they want to buy something, we can check their balance to see if they have enough money for it and then subtract the amount right then.

Since it’s so new, I’m just getting ours set up with targets, goals, and all the rest, but I’ll be updating everyone on Facebook as we start using it more consistently. I think it’s not only going to be a great way to keep track of the kids’ money, but also a fantastic way to teach them financial responsibility and independence.

TIP: There are so many features that it can be a little overwhelming at first. I highly recommend the video tutorials on YouTube. They cover one topic at a time and are short enough that you can watch them whenever you have a couple of minutes free.

I may still be setting things up the way we want them (the boys have already decided that they want to start saving towards a GoPro and an iPod… not sure we’ll agree to that second one), but the first thing I did when I signed us up was put $5 into Eli’s account to finally make up for the money I stole from him the day of the field trip.

I know we’ll still need cash here and there and we’ll definitely still teach the kids with cash, but I’m hopeful that Kidibank will help us give them a more well-rounded financial education.

Follow me on Facebook to keep up with our progress!

YOU CAN GET A FREE MONTH TRIAL OF KIDIBANK! LEARN MORE AT THEIR WEBSITE.

J. Ivy Boyter says

Wow, I like this concept a lot. I recently started teaching my daughter about credit, since she’s always wanting more than she has money for. That tends to stop her in her tracks when she asks for things … at 5, the idea of not seeing the money and “owing” us really bugs her. “It’s not fair!” LOL.

What a great app! Thanks for sharing.

Kristen Hewitt says

This is SO cool! I totally need to do this, thanks for sharing your experience. And I agree, we need to use more cash and teach kids the VALUE of money as well as how to use it.